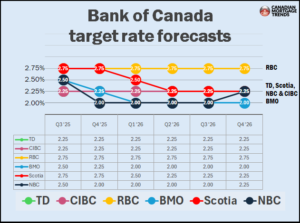

Canada’s big banks are divided on how much further the Bank of Canada will cut, with RBC now saying the rate has likely bottomed, while others still expect more easing ahead.

Fed’s interest rate hike policy. Profits from raising interest rates or investments. A businessman looking through a telescope standing next to a percentage sign. flat vector illustration.

The outlook for interest rates is becoming less clear-cut as Canada’s major banks rethink how far the Bank of Canada will go in its rate-cutting cycle. While most still see room for further easing, RBC is breaking away from the pack.

The bank has taken additional cuts off the table, forecasting the overnight rate will hold steady at 2.75% through 2026—making it the most hawkish forecast among the Big Six.

In its latest Monthly Forecast Update, RBC said: “We no longer expect any rate cuts from the BoC this year.” The bank explained that “as direct trade uncertainty facing Canada recedes…the inflation outlook remains uncertain,” reducing pressure on the central bank to act further.

That’s a shift from earlier this year, when RBC still expected one more cut before the cycle ended.

By contrast, Scotiabank has revised its forecast lower, now projecting the policy rate to settle at 2.25%—down from 2.50% in its previous estimate. BMO, meanwhile, remains the most dovish, continuing to project a fall to 2.00% by early 2026.

TD, CIBC and National Bank continue to expect a terminal rate of 2.25%, in line with the Bank of Canada’s current inflation outlook.

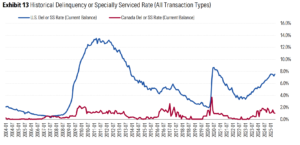

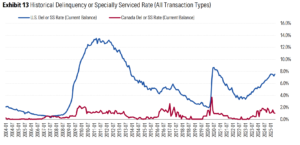

CMBS delinquencies edge down as payoff activity stays strong

Canadian CMBS delinquencies ticked lower in May, with Morningstar DBRS reporting a 1.0% delinquent or specially serviced rate—down from 1.1% in April and well below the U.S. rate of 7.5%.

According to Morningstar DBRS, overall maturity payoff rates held at 100%, with no realized losses reported in May. Loans across all size categories and debt service coverage ratio (DSCR) tiers were paid in full at maturity or prepaid ahead of schedule.

The number of loans still operating under pandemic-era forbearance also continued to decline. As of May, 19 loans with deferred balances remain, though most have resumed regular payments. Outstanding balances tied to forbearance are now concentrated in select property types—particularly retail and hotel assets—and are mostly located in Ontario and Quebec.

Morningstar DBRS also flagged that while most COVID-impacted loans are performing again, a few continue to show signs of strain, particularly those in regions hit hard by broader economic shifts.

Overall, the report suggests continued resilience in the Canadian CMBS market, with improving delinquency trends and strong repayment performance.

Ontario credit union assets edge higher in Q4, but mortgage growth remains slow

Ontario’s credit unions continued to expand their balance sheets in Q4 2024, with total assets rising to $99.61 billion, up 3.37% year-over-year, according to FSRA’s latest Sector Outlook report.

Growth was led by a $1.42-billion jump in commercial lending and a 9.44% increase in cash and investments. Residential mortgage growth remained muted, up just 1.02% annually, reflecting subdued housing activity.

Profitability improved slightly, with return on average assets rising to 0.24%, up three basis points from Q3, driven by lower interest paid to depositors.

However, credit quality showed some deterioration. The delinquency rate on residential mortgages climbed to 0.87%, up 31 basis points from a year earlier.

FSRA noted the broader debt picture is improving, as StatCan data shows Canada’s household debt-to-income ratio declined to 170.1% in Q3 2024, down from 175.0% a year earlier.

Many renters still holding off on buying, despite falling rates and prices

More than a quarter of Canadian renters considered buying before signing or renewing their current lease, according to a new Royal LePage survey, but most ultimately chose to wait.

Even with home prices softening and borrowing costs easing, 40% of surveyed renters said they’re holding out for even lower prices. Another 29% are waiting for further rate cuts, while 28% say they’re still saving for a down payment.

Despite these hurdles, 54% of renters say they plan to buy eventually. Of those, 16% hope to do so within two years, and 21% within five.

“Entry-level opportunities have improved significantly,” said Royal LePage CEO Phil Soper, who noted that incomes are rising and some of the least affordable cities are becoming more accessible. “Still, many renters… are choosing to wait. History suggests they may be disappointed.”

A growing supply of purpose-built rentals and softer demand—partly due to capped international student permits—has also eased rental prices. According to Rentals.ca and Urbanation, average national rents for one- and two-bedroom units declined 3.6% and 4.6% year-over-year, respectively, in May.

Still, affordability remains an issue. Nationally, 37% of renters spend between 31% and 50% of their net income on rent, and 15% spend more than half. Many are also cutting back—on groceries, savings, or even taking on second jobs—to keep up.

“Even with several months of decreases, rents are still significantly higher than they were just a few years ago,” Soper said, calling for “meaningful policy action” to restore long-term affordability.

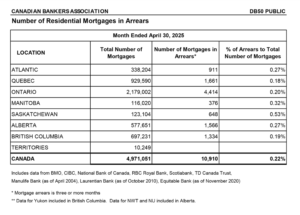

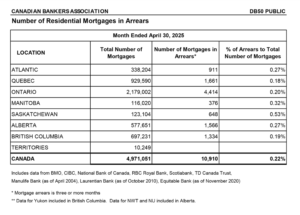

Mortgage arrears edged up slightly in April

The number of Canadian mortgages in arrears ticked up slightly in April, reaching 10,910 loans, or 0.22% of all residential mortgages, according to the latest data from the Canadian Bankers Association.

Saskatchewan continues to report the highest arrears rate in the country at 0.53%, followed by Manitoba at 0.32% and both Atlantic Canada and Alberta at 0.27%. In contrast, Quebec (0.18%), British Columbia (0.19%), and Ontario (0.20%) all remain below or near the national average.

Despite the modest increase, arrears levels remain low by historical standards, and well below the current 1.52% mortgage arrears rate in the U.S.

This is most of an article written for Canadian Mortgage Trends (click for full article) by:

Steve Huebl

Steve Huebl is a graduate of Ryerson University’s School of Journalism and has been with Canadian Mortgage Trends and reporting on the mortgage industry since 2009. His past work experience includes The Toronto Star, The Calgary Herald, the Sarnia Observer and Canadian Economic Press. Born and raised in Toronto, he now calls Montreal home.