As variable-rate mortgage holders eagerly anticipate the Bank of Canada’s first rate cut, fixed rates are heading in the other direction: up.

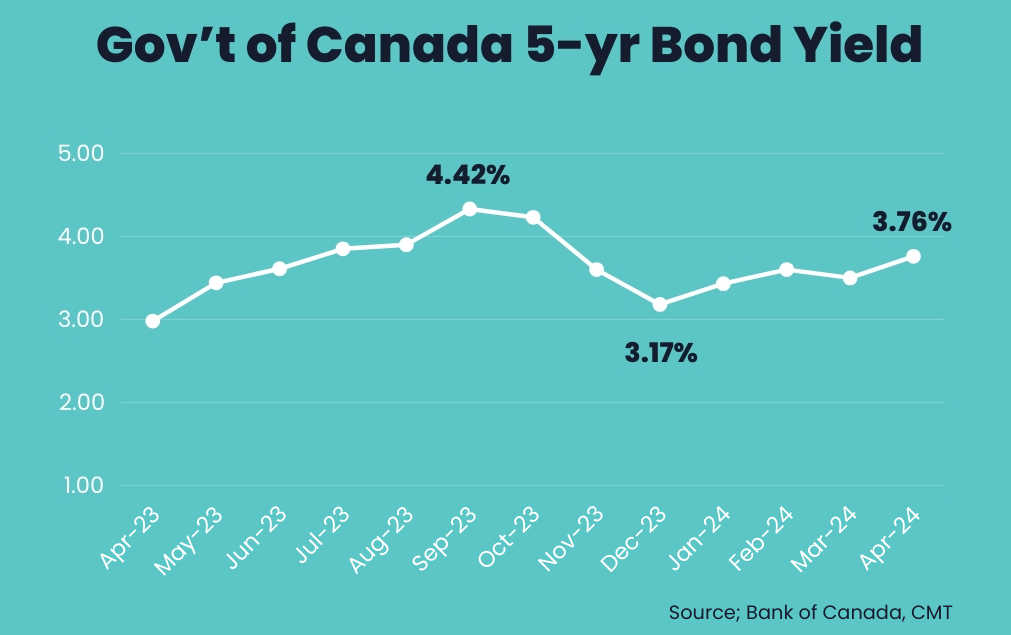

After peaking in early October, Government of Canada bond yields—which lead fixed mortgage rates—plummeted by 125 basis points, or 1.25 percentage points, by early January.

Since reaching that low, they’ve rebounded by approximately 60 bps, with around 25-bps worth of those gains seen in the past three weeks. As a result, fixed mortgage rates are being taken along for the ride.

Strong economic data to blame

Rate expert Ron Butler of Butler Mortgage says 2- to 5-year fixed mortgage rates are up across various lenders by anywhere from 15 to 30 bps in recent weeks.

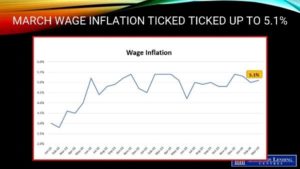

Butler says the gains are being driven primarily by recent U.S. data, including strong employment, GDP and inflation figures.

As we reported earlier this month, U.S. CPI inflation in March was up 0.4% month-over-month and 3.5% on an annualized basis. That caused some economists to speculate that U.S. rate cuts could get pushed out to later this year, or potentially even until next year.

On Wednesday, U.S. Federal Reserve Chair Jerome Powell seemed to confirm those calls when he said a “lack of further progress” on the inflation front could lead to interest rates staying higher “for as long as needed.”

In Canada, where GDP growth and employment have held up better than expected, markets still see the first Bank of Canada rate cut being delivered at either its June or July rate meetings, though that can always change.

Where could fixed rates go from here?

Rate expert and mortgage broker Ryan Sims, who predicted the rise in rates in a CMT column published earlier this month, thinks fixed rates still have some room to rise.

“I still see mortgage rates going up, although I would think another 20 to 30 bps would do it,” he told CMT. “The gap between fixed and variable is too much, and the bond market had priced in a lot of cuts that I don’t think will happen for a lot longer than people thought.”

The average deep-discount 5-year fixed rate available for insured mortgages (those with a down payment of less than 20%) is currently around 4.79%. “I think we see it get to 5.29%,” Sims said.

While fixed rates are widely expected to resume their decline once Bank of Canada rate cuts are imminent, Sims says there’s a wildcard that should be considered: that fixed rates continue to rise even as the BoC’s benchmark rate falls.

“Canada’s fiscal policy is in bad shape, and I think you could see government bonds, and by default mortgage rates, pick up—regardless of [BoC Governor] Tiff Macklem dropping overnight rates,” he said. Rate cuts that are delivered too soon could be seen as a “panic move” by international markets and help drive yields higher, he notes.

“People forget that interest rates are about perceived risk, and after [this week’s] budget, risk in Canada, at least from an investing perspective, went up,” Sims added. “I could easily see another 20 to 30 bps into Canada government yields over the next 12 to 18 months just on risk—regardless of what overnight rates actually do.”

This article was written for Canadian Mortgage Trends by: