After spending most of the past year at or near record lows, Canada’s mortgage delinquency rate is expected to return to pre-pandemic levels, potentially rising by nearly a third.

That’s the latest forecast from RBC Economics, which points to a “looming” recession and an expected increase in the unemployment rate to 6.6% by next year as catalysts for more Canadians falling behind on their mortgages.

“The noticeable improvement in Canadians’ finances (in the aggregate) early in [the] pandemic wasn’t sustainable,” wrote RBC’s Robert Hogue and Mishael Liu. “Those gains are now reversing and will likely erode further amid a softening economy and higher interest rates.”

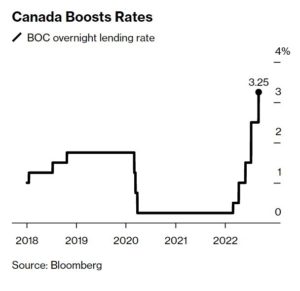

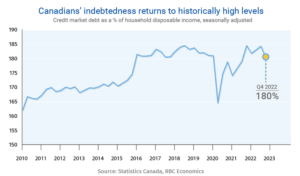

Despite most Canadians’ financial situations having improved over the course of the pandemic, the RBC report points to the end of government support programs, a rising cost of living and skyrocketing interest rates as factors that are causing a growing number of borrowers to fall behind on their debt payments.

Delinquency rates rising on non-mortgage debt, mortgages to follow

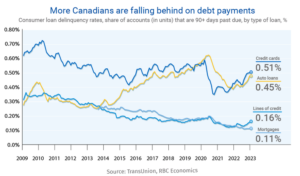

The report points to rising delinquency rates for non-mortgage debts, such as credit cards, auto loans and lines of credit, which are often a precursor to mortgage delinquencies.

Mortgage delinquencies, while rising slightly from their record low, are considered a backward-looking indicator, which tells us more about what was happening a year ago than it does today, Ben Rabidoux of Edge Realty Analytics has pointed out.

That’s because when a borrower loses their job, they typically have savings that can get them by for six months to a year, or get a mortgage refinance. On top of that, mortgages aren’t considered delinquent until they are at least 90 days overdue.

“What’s a much better indicator is looking at things like credit card delinquencies, [which are] definitely ticking up,” he said on a call for clients earlier this year. “So, you can kind of roll forward six months and this is going to be the trend in mortgage delinquencies.”

Credit ratings agency Equifax Canada has also reported on rising non-mortgage debt delinquencies, which were up 11% in the fourth quarter of 2022. Among mortgage holders, the rise in non-mortgage delinquencies was up by 6% year-over-year.

Among mortgages, delinquency rates remain just off all-time lows at 0.15% as of February, according to the Canadian Bankers Association, with rates highest in Saskatchewan (0.62%) and lowest in Quebec at 0.11%.

Canadians more interest rate-sensitive than ever

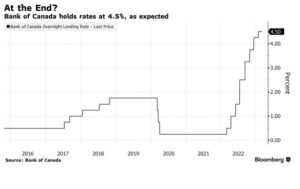

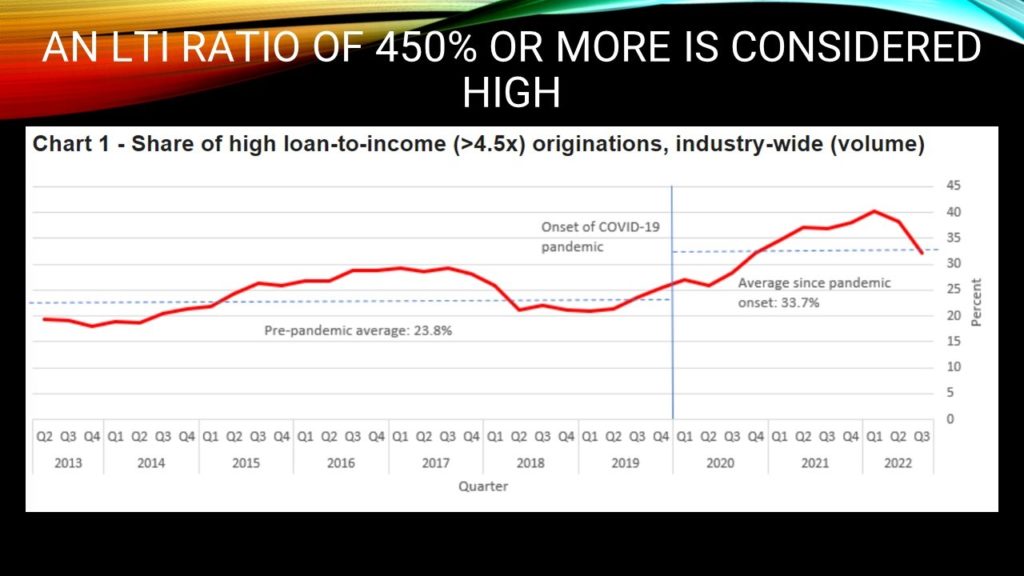

While an expected rise in the unemployment rate is expected to reverse about half of the decline in mortgage delinquencies over the coming year, the RBC report notes that a combination of higher debt loads and higher interest rates, which have made Canadians “more interest rate-sensitive than ever,” will play a role too.

As a result, delinquency rates are expected to continue trending higher into the medium to longer term “as earlier interest rate hikes and heavier debt-service loads catch up with financially-stretched mortgage holders.”

While variable-rate mortgage holders have already felt the pain of higher interest rates in many cases, RBC says this will “also become the reality for fixed-rate mortgage holders once their term expires.”

RBC suggests those at greatest risk are borrowers who bought a home between late 2020 and early 2022, when interest rates were at their lowest. The impact of higher rates for fixed-rate mortgage holders are expected to come at renewal time generally between 2025 and 2027.

Even though the report’s authors expect the market to remain “challenging for years to come,” they say a full-out economic collapse is “unlikely.”

“We expect any financial troubles to remain relatively contained in the short to medium terms,” they noted.

This article was written by Steve Huebl and re-posted from the Canadian Mortgage Trends website:

RBC sees mortgage delinquencies rising nearly 30% in the coming year

The Bank of Canada Hiked Rates Again And Isn’t Finished Yet

The Bank of Canada Hiked Rates Again And Isn’t Finished Yet