In addition to the stats on renting vs buying there’s some great economic data following!

This article was written by Steve Huebl for Canadian Mortgage Trends: Renting vs. buying in today’s market: how monthly payments compare

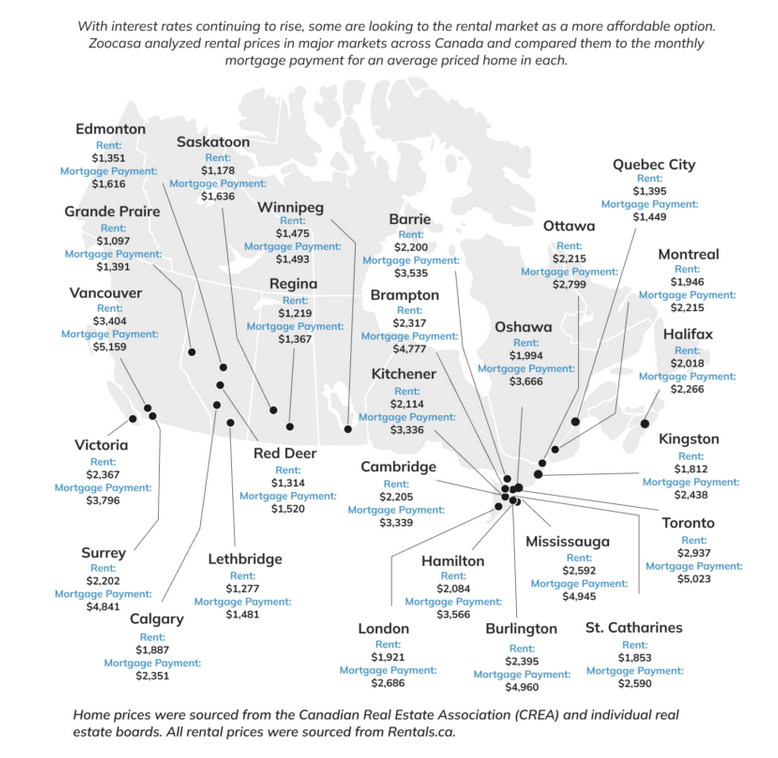

A new study has found the cost of renting vs. buying comparable housing in select Canadian markets is nearly on par.

In fact, the difference between renting and buying was less than $500 per month in 11 different markets, according to the report from Zoocasa.

“Though no market is more affordable to buy in than rent, there are several markets where the rental and mortgage payments are similar, though these are all outside of Ontario and British Columbia,” the report notes.

For example, in Winnipeg the average monthly rent is $1,475, while the average mortgage payment was calculated at $1,493, for a difference of just $18. Similarly in Quebec City and Regina, the Zoocasa report found average rents were just slightly more affordable, by $54 and $148, respectively, per month.

It’s important to note that the study didn’t factor in other costs such as utilities, maintenance or property taxes.

In other markets, the monthly cost between renting and owning was more drastic. The largest payment difference was found in Surrey, B.C., where the average mortgage payment was calculated at $2,639 more than the cost of renting. Similar large gaps were seen in the Ontario cities of Burlington and Brampton.

The results were in contrast to a 2021 Royal LePage survey that found, on average, the cost of homeownership was actually less than the cost of renting a comparable housing unit. At that time, of course, homeowners were benefiting from record-low interest rates.

Zoocasa said the average rental rates were sourced from Rentals.ca, while mortgage payments were based on average house price data from the Canadian Real Estate Association and calculated assuming a 20% down payment, and a 5.04% rate amortized over 30 years.

Other mortgage and real estate stories…

Bank of Canada expected to keep benchmark rate at 5%

The Bank of Canada’s benchmark interest rate is expected to spend the remainder of the year at its current 22-year high of 5.00%, according to a median of responses from market participants.

The findings were released in the Bank of Canada’s second-quarter Market Participants Survey, which surveyed 30 financial market participants between June 8 and 19, 2023.

Asked for their forecast for the Bank of Canada’s policy interest rate, respondents were near-unanimous in believing the policy rate will remain at 5% through the end of the year.

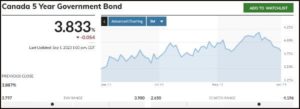

That’s contrary to current bond market pricing, which currently sees a near 80% chance of one more quarter-point rate hike at the Bank’s September meeting.

Most survey respondents expect rates to fall to 4.75% by March 2024, and believe the benchmark rate will end 2024 at 3.50%. By the third quarter of 2025, a median of responses from participants see the Bank of Canada cutting rates further to 2.50%.

The respondents pointed to higher interest rates as the top risk facing economic growth in Canada, followed by tighter financial conditions and a decrease in purchasing power.

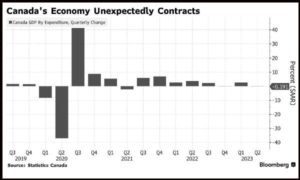

A majority of respondents also now believe Canada will skirt a recession and see annual gross domestic product growth remaining positive throughout both 2023 (+0.7%) and 2024 (+1.2%). In the first-quarter survey, the median forecast was for slightly negative growth in 2023.

On inflation, the participants expect total CPI inflation to slow to 3% by the end of 2023 (up from 2.7% in the previous survey), easing further to 2.2% by the end of 2024 (unchanged from the Q1 survey).

Canadian job vacancy rate drops to two-year low

Canada’s job vacancy rate continued to trend down in May, reaching a two-year low.

Statistics Canada reported on Thursday that the number of unfilled positions fell to 759,000 in May, a decline of 26,000 from April. The declines were concentrated in Quebec (-10,800), Manitoba (-3,700) and Saskatchewan (-2,400).

This resulted in the job vacancy rate falling to 4.3%, down by 0.1% from the previous month. Compared to last year, the job vacancy rate is down by 1.5 percentage points.

The StatCan report shows the number of payroll employees rose by 129,900 in the month, led by gains in public administration (106,200) and healthcare and social assistance (+7,000).

Average weekly earnings were up 3.6% on an annual basis to $1,200.75. That’s up from the 2.9% pace reported in April.

U.S. Fed hikes interest rates

On Wednesday, the U.S. Federal Reserve raised its benchmark borrowing costs to the highest level seen in more than 22 years. The Federal Open Market Committee (FOMC) raised the fed funds rate to a target range of 5.25% to 5.5%. The midpoint of this range represents the highest benchmark rate level since early 2001.

Financial markets had largely expected this rate hike.

Fed Chairman Jerome Powell noted during a news conference that inflation has shown some moderation since the middle of the previous year, but still has a way to go to reach the Fed’s 2% target. Powell left open the possibility of maintaining rates at the next meeting in September, stating that future decisions would depend on carefully assessing incoming data and its impact on economic activity and inflation.

“It’s certainly possible we would raise (rates) again at the September meeting, and it’s also possible we would hold steady,” he said.