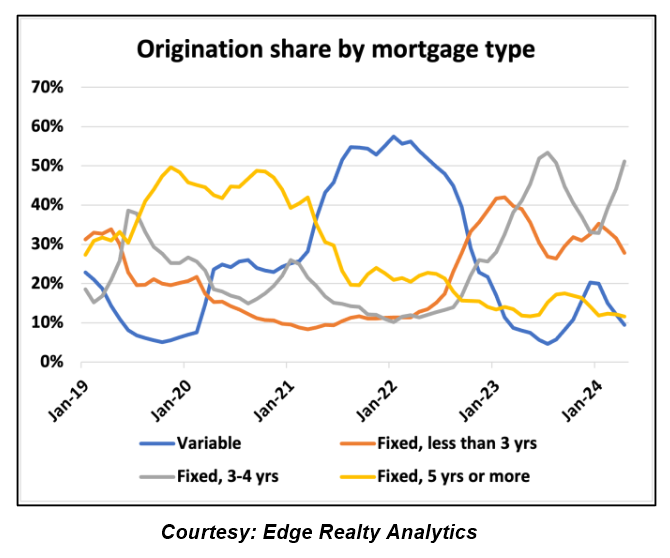

Mortgage borrowers are increasingly opting for variable-rate mortgages, a trend that is expected to continue as the Bank of Canada continues to lower interest rates.

As of the first quarter, 12.9% of new mortgage borrowers opted for a variable-rate mortgage, according to figures from the Bank of Canada.

That’s up from a low of 4.2% reached in the third quarter of 2023, but down from a peak of nearly 57% of originations reached during the pandemic when most variable rates were available for less than fixed-rate products.

A variable-rate mortgage is one where the interest rate can change over time, typically in relation to the Bank of Canada’s overnight target rate.

More recent data show that while the popularity of variable-rate mortgages eased heading into the spring—and just ahead of the Bank of Canada’s quarter-point rate cut in June— their share of originations are up 50% from a year ago.

“But for context, they accounted for just 9% of total originations in April and were 90% lower than the same month in 2022,” noted Ben Rabidoux of Edge Realty Analytics.

Still, variable-rate mortgages are expected to regain a larger share of originations in the months ahead.

“I do expect that we’ll see a sharp increase in variable originations in the next few months once it becomes clear that the Bank of Canada really is on a serious rate-cutting cycle,” he wrote in his newsletter to subscribers.

Meanwhile, shorter fixed-rate mortgages are among the most popular choices for today’s borrowers, as they balance a shorter term and competitive rates. More than 50% of new mortgage borrowers selected a 3- or 4-year fixed term in April.

The Bank of Canada figures also showed that mortgage credit growth reached a 24-year low in the month of just 3.4%.

In other news…

“We’d rather act too early and aggressively”: OSFI on managing risk

In a recent webcast, the head of Canada’s banking regulator emphasized the importance of proactive risk management when it comes to financial stability.

“We would rather face criticism for acting early and too aggressively than face criticism for acting too late,” said Peter Routledge, head of the Office of the Superintendent of Financial Institutions (OSFI). This proactive stance is crucial to maintaining stability in Canada’s financial system.

He noted that the financial system is highly interconnected, meaning that weaknesses in one area can quickly spread, and that it’s OSFI’s role is to mitigate those risks.

“Our job at OSFI is to make sure that everyone within our jurisdiction remains well prepared to withstand shocks that could occur,” he said. “I would say the shocks that we feared last year never materialized. I hope I can say the same thing next year.”

Routledge also touched on the high interest rates that have posed challenges to households and businesses, requiring vigilance with regulatory measures to maintain financial stability.

That includes OSFI’s announcement in March that federally regulated banks will have to limit the number of mortgages that exceed 4.5 times the borrower’s annual income, or in other words those with a loan-to-income (LTI) ratio of 450%.

OSFI has said previously that this new loan-to-income limit will help “prevent a buildup of highly leveraged borrowers.”

(Irrelevant sponsor announcement deleted)

What higher-than-expected inflation means for future Bank of Canada rate cuts

Canada’s headline inflation rate rose to 2.9% in May from 2.7% in April, surpassing economists’ expectations and adding some uncertainty to the timing of the Bank of Canada’s future rate cuts.

The Bank of Canada’s preferred measures of core inflation also edged higher, with CPI-median rising to 2.8% (from 2.6% in April) and CPI-trim increasing to 2.9% (from 2.8%).

Shelter costs remained the largest contributor to overall inflation, holding steady at an annual rate of 6.4%. Rent inflation accelerated to 8.9%, while mortgage interest costs slightly eased to 23.3%.

The results were “clearly a step in the wrong direction,” noted BMO Chief Economist Douglas Porter.

“With inflation back on a bumpy path, the outlook for BoC moves is similarly bumpy. For now, our official call remains that the next BoC rate cut will be in September, and this report does nothing to move that needle,” he wrote.

TD’s James Orlando emphasized that “one bad inflation print doesn’t make a trend,” and that inflation remained below 3%.

“But it does speak to the unevenness of the path back to 2%,” he said, agreeing that the central bank will likely wait until September before delivering its second rate cut.

This article was written for Canadian Mortgage Trends by: