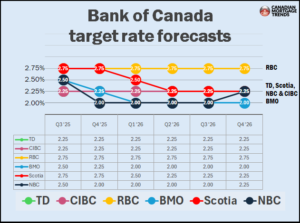

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

While some elements of US trade policy have started to become more concrete in recent weeks, trade negotiations are fluid, threats of new sectoral tariffs continue, and US trade actions remain unpredictable. Against this backdrop, the July Monetary Policy Report (MPR) does not present conventional base case projections for GDP growth and inflation in Canada and globally. Instead, it presents a current tariff scenario based on tariffs in place or agreed as of July 27, and two alternative scenarios—one with an escalation and another with a de-escalation of tariffs.

While US tariffs have created volatility in global trade, the global economy has been reasonably resilient. In the United States, the pace of growth moderated in the first half of 2025, but the labour market has remained solid. US CPI inflation ticked up in June with some evidence that tariffs are starting to be passed on to consumer prices. The euro area economy grew modestly in the first half of the year. In China, the decline in exports to the United States has been largely offset by an increase in exports to the rest of the world. Global oil prices are close to their levels in April despite some volatility. Global equity markets have risen, and corporate credit spreads have narrowed. Longer-term government bond yields have moved up. Canada’s exchange rate has appreciated against a broadly weaker US dollar.

The current tariff scenario has global growth slowing modestly to around 2½% by the end of 2025 before returning to around 3% over 2026 and 2027.

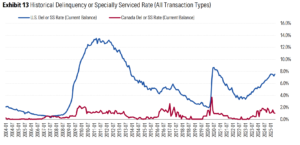

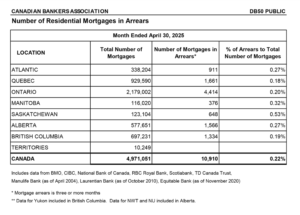

In Canada, US tariffs are disrupting trade but overall, the economy is showing some resilience so far. After robust growth in the first quarter of 2025 due to a pull-forward in exports to get ahead of tariffs, GDP likely declined by about 1.5% in the second quarter. This contraction is mostly due to a sharp reversal in exports following the pull-forward, as well as lower US demand for Canadian goods due to tariffs. Growth in business and household spending is being restrained by uncertainty. Labour market conditions have weakened in sectors affected by trade, but employment has held up in other parts of the economy. The unemployment rate has moved up gradually since the beginning of the year to 6.9% in June and wage growth has continued to ease. A number of economic indicators suggest excess supply in the economy has increased since January.

In the current tariff scenario, after contracting in the second quarter, GDP growth picks up to about 1% in the second half of this year as exports stabilize and household spending increases gradually. In this scenario, economic slack persists in 2026 and diminishes as growth picks up to close to 2% in 2027. In the de-escalation scenario, economic growth rebounds faster, while in the escalation scenario, the economy contracts through the rest of this year.

CPI inflation was 1.9% in June, up slightly from the previous month. Excluding taxes, inflation rose to 2.5% in June, up from around 2% in the second half of last year. This largely reflects an increase in non-energy goods prices. High shelter price inflation remains the main contributor to overall inflation, but it continues to ease. Based on a range of indicators, underlying inflation is assessed to be around 2½%.

In the current tariff scenario, total inflation stays close to 2% over the scenario horizon as the upward and downward pressures on inflation roughly offset. There are risks around this inflation scenario. As the alternative scenarios illustrate, lower tariffs would reduce the direct upward pressure on inflation and higher tariffs would increase it. In addition, many businesses are reporting costs related to sourcing new suppliers and developing new markets. These costs could add upward pressure to consumer prices.

With still high uncertainty, the Canadian economy showing some resilience, and ongoing pressures on underlying inflation, Governing Council decided to hold the policy interest rate unchanged. We will continue to assess the timing and strength of both the downward pressures on inflation from a weaker economy and the upward pressures on inflation from higher costs related to tariffs and the reconfiguration of trade. If a weakening economy puts further downward pressure on inflation and the upward price pressures from the trade disruptions are contained, there may be a need for a reduction in the policy interest rate.

Governing Council is proceeding carefully, with particular attention to the risks and uncertainties facing the Canadian economy. These include: the extent to which higher US tariffs reduce demand for Canadian exports; how much this spills over into business investment, employment and household spending; how much and how quickly cost increases from tariffs and trade disruptions are passed on to consumer prices; and how inflation expectations evolve.

We are focused on ensuring that Canadians continue to have confidence in price stability through this period of global upheaval. We will support economic growth while ensuring inflation remains well controlled.

Information note

The next scheduled date for announcing the overnight rate target is September 17, 2025.

This article was releasted on the Bank of Canada website.