Equitable Bank has announced that, in partnership with a third-party lender, it is introducing a new 40-year amortization mortgage product.

Equitable, Canada’s seventh-largest bank, which provides both prime and alternative lending options, made the exclusive announcement at the National Mortgage Conference that took place in Toronto.

By extending the amortization period beyond the standard 25 or 30 years, the bank seeks to lower monthly payment obligations, making home ownership or investment in properties more accessible amidst the current economic and affordability challenges.

As part of the funding structure for this product, Equitable has partnered with a third-party lender, meaning Equitable will not take on any credit or default risk as the loans won’t appear on its balance sheet.

In essence, Equitable will act as the originator and service provider to its funding partner, providing the underwriting, closing and servicing over the life cycle of the loans.

Here’s what we know about the product:

Product Availability

- The product will cater not only to regular owner-occupied purchases and refinances, but also to rental properties and investor portfolios

- Initially, it will be available in British Columbia, Alberta and Ontario, with a vision for expansion based on its success and market demand.

- Specific target markets will be based on where there is high demand and where it is likely to benefit clients the most

Launch date:

- Details of the product are expected to be available to mortgage professionals this week

Pricing:

- Although exact pricing was not yet available, rates are expected in the 9% range given that this is an uninsured alternative lending product with an extended amortization and potential higher risks

Response to market conditions:

- The product is being introduced at least partially in response to affordability concerns exacerbated by high prices and the rising cost of living. CMT was told it aims to provide financial relief for clients seeking debt consolidation through refinancing, as well as those looking to purchase in challenging economic circumstances.

In other news…

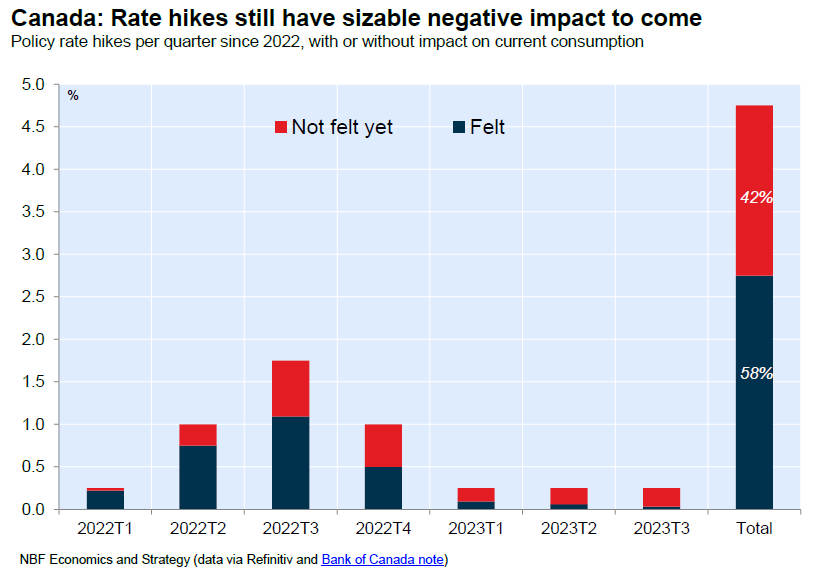

“Sizeable” rate hike impacts yet to be felt: National Bank

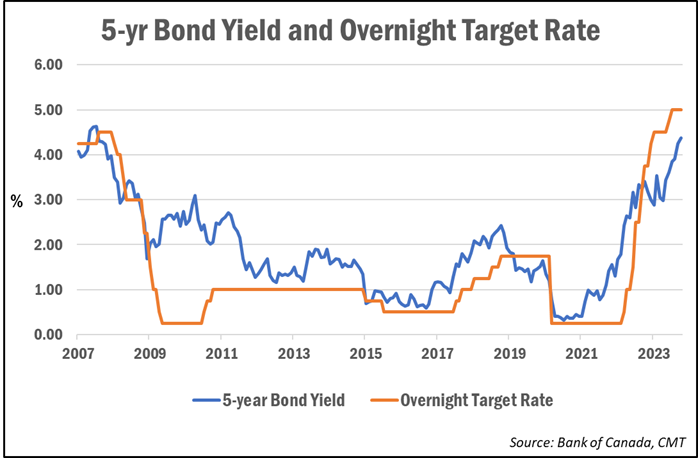

Following the release of declining retail sales in August, National Bank said consumer consumption is expected to remain weak for “some time” given the lag of previous rate hikes.

“Given the long lag between interest rate hikes and their full impact on consumption, there is every reason to believe that weakness will continue for some time, economists Matthieu Arseneau and Alexandra Ducharme wrote in their research note.

By the Bank of Canada’s own estimation, the impact of interest rate hikes can take up to eight quarters, or two years, to be entirely felt at the consumer level.

“…we calculate that 42% of the impact of the huge rate hikes announced since March 2022 has yet to be felt,” Arseneau and Ducharme noted.

“For this reason, it would be perilous for the Central Bank to focus on the resilience of core inflation in its rate decision [this] week, as this indicator reacts with a lag to the economic situation which looks set to be moribund over the next 12 months,” they added. “We expect the Bank to hold its policy rate steady [on] Wednesday.”

One in six mortgage holders finding their mortgage “very difficult”

A new survey has found that one in six mortgage holders (15%) say they find their mortgage payments “very difficult.”

That’s double the amount compared to March, according to the Angus Reid Institute.

Even if the Bank of Canada leaves rates unchanged going forward, many mortgage holders say they are concerned about the financial impact at the time of their mortgage renewal.

The survey found 40% are worried while 39% are “very worried” about the prospect of higher payments at renewal.

Those facing renewal in the next year are most concerned, with 57% saying they are “very worried” that their monthly payments will rise significantly.

Meanwhile, nearly half of all Canadians (49%) say they are in a worse financial position than they were compared to a year ago.

60% of Canadians exceeding the recommended 30% limit on housing expenses

More than 6 in 10 Canadians (61%) are spending more than the CMHC’s recommended limit of 30% of pre-tax income on housing.

That’s according to a Leger survey commissioned by ratefilter.ca, which surveyed both renters and homeowners.

On average, Canadians are spending 41% of their pre-tax income on housing. Meanwhile, Canada’s housing agency, the Canada Mortgage and Housing Corporation (CMHC), recommends a limit of 30%.

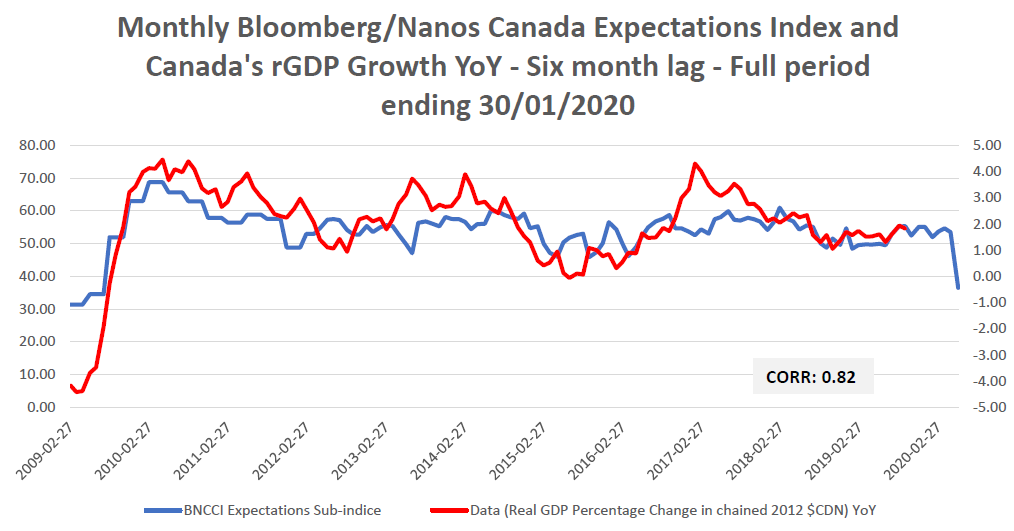

Consumer confidence dips into negative territory

For the first time since April, consumer confidence in Canada has fallen into negative territory, according to a weekly survey by Bloomberg and Nanos.

The Bloomberg Nanos Canadian Confidence Index (BNCCI) fell to 49.45, down from 50.93 four weeks ago and a 12-month high of 53.12. A score below 50 indicates a net negative economic outlook by Canadians. The average for the index since 2008 is 55.58.

The outlook on real estate dipped to 40.79 (from 45.12 four weeks ago), while sentiment on personal finances fell to 13.68 (from 16.04).