December Housing Data Ended 2022 On A Weak Note

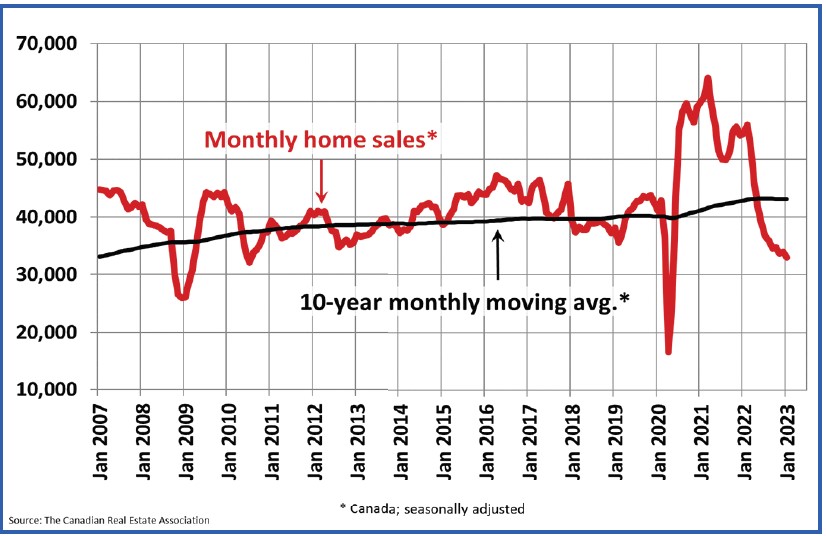

The Canadian Real Estate Association says home sales in January were the lowest for the month since 2009 and fell 37.1% from a year ago. The Canadian housing market has been sliding for eleven consecutive months as the unprecedented rise in interest rates–up from 25 basis points to 4.5% for the policy rate–has moved buyers to the sidelines. This is an abrupt reversal in the fevered pace of home sales during the pandemic.

The rapid rise in interest rates, designed to combat inflation, has driven many buyers to the sidelines. Higher borrowing costs have reduced affordability despite the sharp decline in prices in many regions.

On a regional basis, sales gains in Hamilton-Burlington and Quebec City were more than offset by declines in Greater Vancouver, Victoria and elsewhere on Vancouver Island, Calgary, Edmonton, and Montreal.

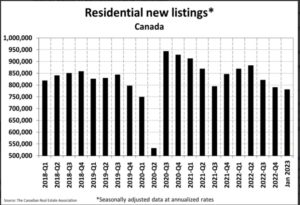

New Listings

Last month, the number of newly listed homes rose 3.3% on a month-over-month basis, led by increases across British Columbia. Despite the slight increase, new listings remain historically low nationally. New supply in January 2023 hit the lowest level for that month since 2000.

With new listings up and sales down in January, sales-to-new listings eased back to 50.7%. This is roughly where it had been over the entire second half of 2022. The long-term average for this measure is 55.1%. There were 4.3 months of inventory on a national basis at the end of January 2023. This is close to where this measure was in the months leading up to the initial COVID-19 pandemic lockdowns, considered historically slow.

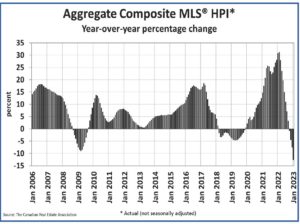

Home Prices

Canadian home prices fell by the most on record in 2022 as rapidly rising interest rates forced a market adjustment that is still ongoing.

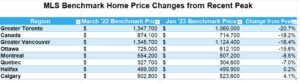

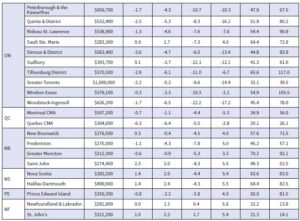

The Aggregate Composite MLS® HPI was 15% below its peak in February 2022. Looking across the country, prices are down from peak levels by more than they are nationally in many parts of Ontario and some parts of B.C. and down by less elsewhere. While prices have softened to some degree almost everywhere, Calgary, Regina, Saskatoon, and St. John’s stand out as markets where home prices are barely off their peaks at all.

In contrast, some East Coast markets have bottomed and appear to be trending higher.

Housing Construction Falls

In other news, CMHC reported that the annual pace of housing starts fell 13% in January. The national housing agency says the seasonally adjusted annual rate of housing starts for the year’s first month was 215,365 units compared with 248,296 in December.

This is very troubling as the population growth in Canada is slated to be very strong, and rental properties are in very short supply. The housing shortage will only rise. Rents have surged in many parts of the country for new inhabitants, straining household budgets even more.

With interest rates high and the cost of construction booming, many developers are moving to the sidelines.

The table below shows the decline in MLS-HPI benchmark home prices in Canada and selected cities since prices peaked in March when the Bank of Canada began hiking interest rates. More details follow in the second table below. The most significant price dips are in the GTA and the GVA, where the price gains were spectacular during the Covid-shutdown.

Even with these large declines, prices remain roughly 33% above pre-pandemic levels.

Bottom Line

The Bank of Canada has promised to pause rate hikes assuming inflation continues to abate. We will not see any action in March. But the road to 2% inflation will be a bumpy one. I see no likelihood of rate cuts this year, and we might see further rate increases. Markets are pricing in additional tightening moves by the Fed.

There is no guarantee that interest rates in Canada have peaked. We will be closely monitoring the labour market and consumer spending.