One of the biggest benefits to purchasing your own home is the ability to build equity in your property. This equity can come in handy down the line for refinancing, renovations, or taking out additional loans – such as a second mortgage.

What is a second mortgage?

First things first, a second mortgage refers to an additional or secondary loan taken out on a property for which you already have a mortgage. This is not the same as purchasing a second home or property and taking out a separate mortgage for that. A second mortgage is a very different product from a traditional mortgage as you are using your existing home equity to qualify for the loan and put up in case of default. Similar to a traditional mortgage, a second mortgage will also come with its own interest rate, monthly payments, set terms, closing costs and more.

Second mortgages versus refinancing

As both refinancing your existing mortgage and taking out a second mortgage can take advantage of existing home equity, it is a good idea to look at the differences between them. Firstly, a refinance is typically only done when you’re at the end of your current mortgage term so as to avoid any penalties with refinancing the mortgage.

The purpose of refinancing is often to take advantage of a lower interest rate, change your mortgage terms or, in some cases, borrow against your home equity.

When you get a second mortgage, you are able to borrow a lump sum against the equity in your current home and can use that money for whatever purpose you see fit. You can even choose to borrow in installments through a credit line and refinance your second mortgage in the future.

What are the advantages of a second mortgage?

There are several advantages when it comes to taking out a second mortgage, including:

- The ability to access a large loan sum (in some cases, up to 90% of your home equity) which is more than you can typically borrow on other traditional loans.

- Better interest rate than a credit card as they are a ‘secured’ form of debt.

- You can use the money however you see fit without any caveats.

What are the disadvantages of a second mortgage?

As always, when it comes to taking out an additional loan, there are a few things to consider:

- Interest rates tend to be higher on a second mortgage than refinancing your mortgage.

- Additional financial pressure from carrying a second loan and another set of monthly bills.

Before looking into any additional loans, such as a secondary mortgage (or even refinancing), be sure to speak to your DLC Mortgage Expert! Regardless of why you are considering a second mortgage, it is a good idea to get a review of your current financial situation and determine if this is the best solution before proceeding.

Published by the DLC Marketing Team – September 27, 2022

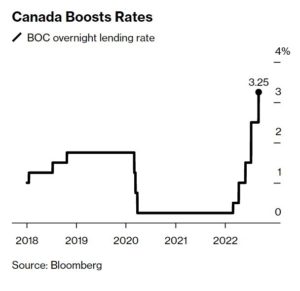

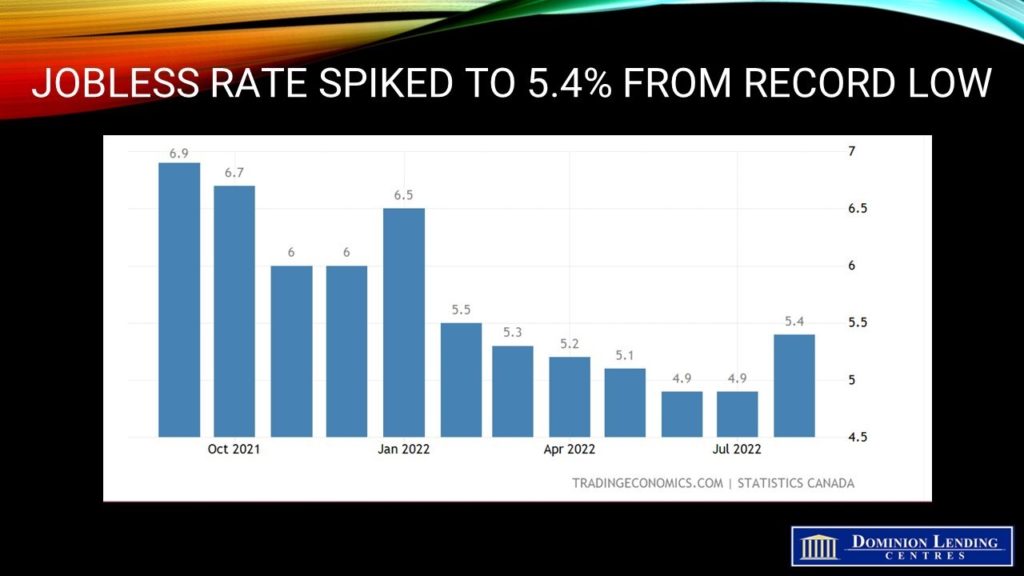

The Bank of Canada Hiked Rates Again And Isn’t Finished Yet

The Bank of Canada Hiked Rates Again And Isn’t Finished Yet